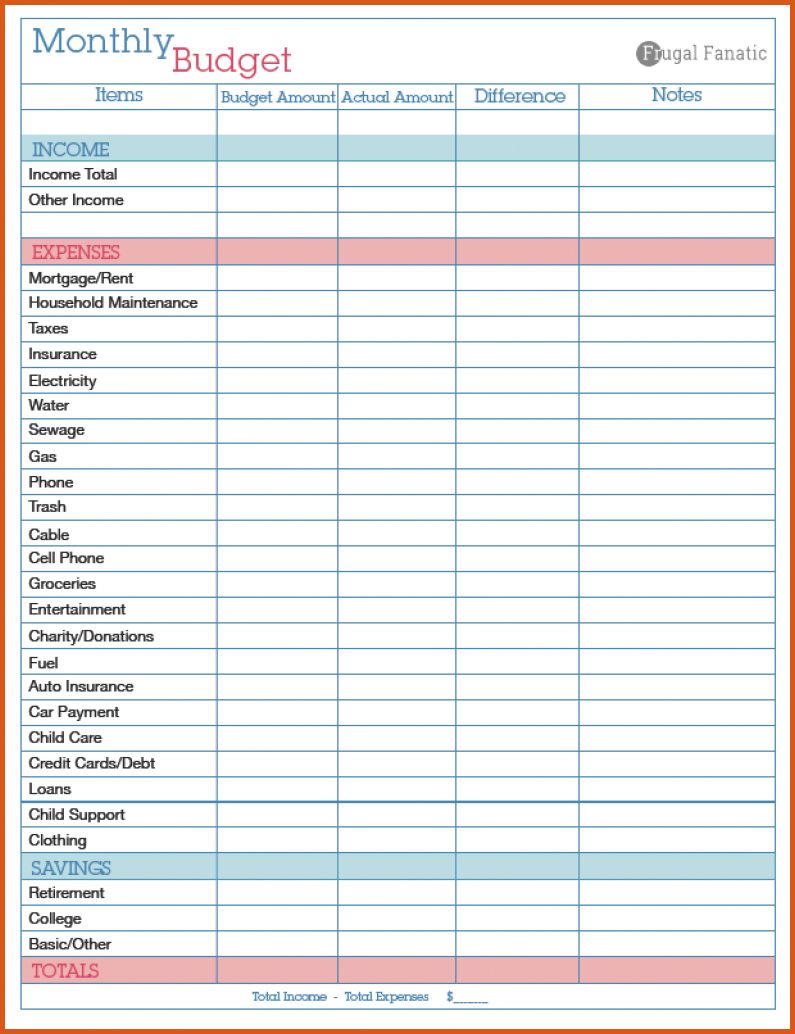

#Budget spreadsheet download

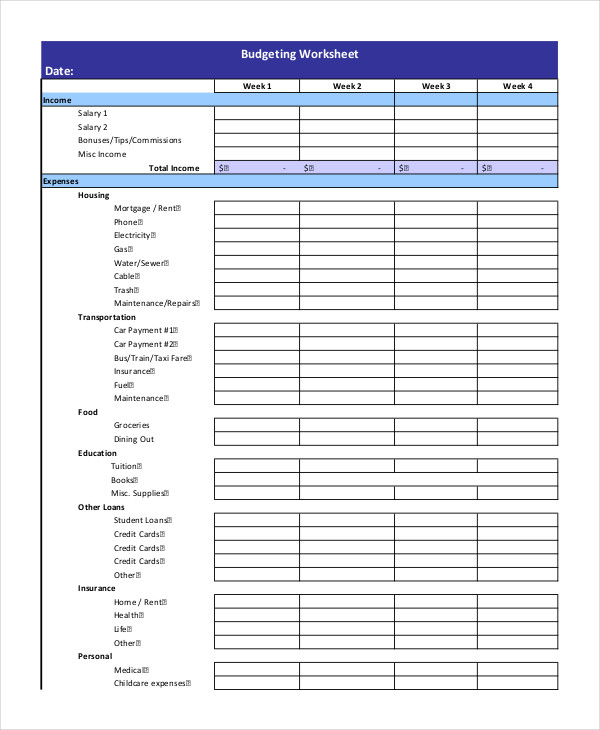

See Budget Spreadsheet – Variable Expenses in the free budget worksheet download below. Write your new amount under each variable column for your new budget amount and then calculate the approximate difference from the average. Is this a reasonable amount for your budget or should you go even lower? Once you’ve identified areas to reduce spending, look at the months you spent the least.

If your spending is under control and you’ve cut what you could from fixed expenses but still know you need more cash flow, you may need a temporary second job or need to take advantage of government assistance. Anytime you have above the amount in a particular category you can place that amount in savings or add to your house payment, for example. This will prevent your family from going into debt. In this case, take your averages as they are today and move forward with a budget, without cutting anything. Your spending may be under control, but that doesn’t mean you don’t need a budget. Related: Why You Should Never Withdraw Money from the ATM For more ideas check out 44 ways to easily save money. I don’t have cable, so I’m here to tell you it’s very much possible to live without it.Īnother unpopular place to save under Fixed Expenses is with our Internet and Phone bill. One obvious but unpopular way is cutting out cable. There is almost always room under Fixed Expenses for improvement for everyone. If so there are a few ways to approach this.

Once you have gathered 3-6+ months of your spending data, figure the monthly average for each category.

#Budget spreadsheet how to

Related: Teach Your Child How to Create a Budget Step 2: Analyze Spending You most likely won’t find substantial savings in these areas, although there is some room, see below. You can gather this information from last month’s bills. You don’t necessarily need 3-6+ months of data to fill this category in and for this reason it isn’t inside in the worksheet. These expenses are the ones that don’t change or the ones you don’t have much control over, although sometimes you can opt to pay more. Related: 10 Effective Ways Single Parents Can Cut Monthly Expenses Fixed Expenses These are expenses that change each month and the ones you have the most control over. How to break your purchases down: Variable Expenses

0 kommentar(er)

0 kommentar(er)